15 months ago, in January 2020, in our article What’s Next For the Single Family Real Estate Market & Is Now A Good Time To Invest?, we examined the state of the market and speculated on what the future would hold.

We presented a graph showing the steady and healthy rise of housing prices since 2012. A solid 8 year run of appreciation that seemed destined to flatten out . Conversely, we showed the supply/demand dynamics signaling a chance prices could rise more.

In this article we will do a retrospective on the last 5 quarters and then ask the same question once again.

What happened over the last 15 months and was January 2020 a good time to invest?

I’ll get right to the point. Early 2020, if you had the stomach to bear an unprecedented market event (Global Pandemic), was a very good time to invest in single family homes.

Here’s what happened:

In an already supply constrained market 2 powerful things occurred that drove very strong demand even higher.

1) Historically low mortgage Interest rates plummeted even further

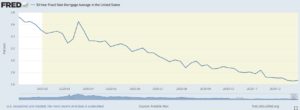

The chart below shows what happened to interest rates in 2020.

As you can see, the average 30 year mortgage started 2020 at about 3.7% and ended the year at close to 2.7%. Dropping 1 full percentage point in 12 months from a starting point of 3.7% is a drastic decline.

For context, on average, the payment on a $400,000 loan dropped from $1,841 to $1,622, a difference of $219 per month. When payments go down, people are willing and able to pay more for homes. With such low supply, bidding wars result which drives up prices.

Personally, I never thought I would ever want to refinance my primary residence with its 30 year term and 4% interest rate. Never say never. In 2020, I was able to lock in a 30 year 2.625% loan with no points which cut my mortgage payment by 33%. This will save us a significant amount of money each month.

2) The usefulness of single family residences suddenly grew significantly

Historically, for the most part, single family homes have provided families with a place to sleep, cook, eat and spend leisure time. With the advent of the pandemic, this suddenly changed.

With schools, gyms and office buildings shutting down, the home also became these things as well. When the usefulness of something expands, by nature, the value of it increases. Moreover, people and families living in densely populated areas and in apartments needed the additional space and yards that suburban single family homes provide

Despite an overall economic recession, these demand catalysts helped drive the median home price up 8.4% in 2020.

Remember, as real estate investors we know that when we intelligently use leverage to acquire homes, our return on investment from appreciation is greater than the amount by which the home increases.

For example if you bought a $200,000 investment home in January of 2020 using a 25% down payment, your investment (not including closing costs) was $50,000. An 8.4% increase in the value of the home means your home appreciated by $16,800. While the bank financed 75% of the property, YOU own 100% of the appreciation. The ROI on the $50,000 you invested is $16,800/$50,000 = 33.6%.

And remember, this calculation does not take into account the tax sheltered cash flow you earned and the equity you earned from your tenant paying down your mortgage.

From a personal perspective, I got into contract on two new construction 4 plexes in the middle of 2019. Construction finished and we were ready to close on March 31st, 2020. Given the economic shutdown from COVID was about 2-3 weeks old at closing time and there was significant uncertainty, I was seriously debating forfeiting my security deposit and walking from the deals. After significant additional risk/reward analysis, I decided to move forward. I am glad I did

At the start of 2021, I had the 4-plexes appraised as part of taking out HELOC’s on them. (see The BRRRR Method & The CLEER Method) Based on the appraisals, the properties had appreciated by 25.3%.

So yes, assuming you bought right (See The Market, The Deal, The Team) 2020 was a great time to acquire real estate.

What does the next 15 months look like in the single family market? And is now a good time to buy?

While everyone needs to evaluate their own risk tolerance and personal situation, assuming you buy right and do not have a short term time horizon, I believe now is once again a great time to buy

Here’s 4 reasons why:

1) Supply

The below graph from the National Association of Realtors shows the months of supply of homes for sale since 2011. The market is considered in equilibrium when there are 6 months of supply. At the end of 2020 the market had 1.9 months of supply.

While owner occupant home builders and single family residential REITS (Invitation Homes, American Homes For Rent etc.…) are seeing the opportunity and furiously working to increase supply, it will take time.

With supply this low, prices feel destined to continue rising.

2) Demographics show demand will continue to increase

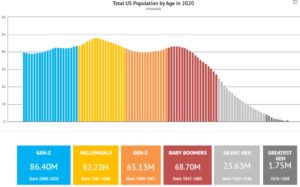

The below chart shows the 2020 U.S. population by age and generation.

The largest cohort is the millennials which represent a population that is 26% larger than the previous generation – Gen X’ers. Many of these millennials are just now or soon will be coming into the prime ages for home buying. Behind them is Generation Z, another large cohort of people who will need places to live.

With elderly folks both living longer and aging in place longer, in part due to a pandemic induced reluctance to move into assisted living facilities, the demand for single family homes from older generations is also very strong. We wouldn’t expect the typical rate of new supply coming on the market from this cohort as they age. As per the U.S Census Bureau there are approximately 4 million people aged 55 or over who rent single family homes.

Basic microeconomics tells us when supply is low and demand is high and expected to rise more, prices will also rise.

3) High inflation could kick in

It’s no secret that the government has responded to the pandemic by “printing” massive amounts of currency. More dollars chasing the same or similar amount of goods and services historically has led to inflation. Given the degree of money printing we could see high inflation kick in abruptly.

As consumers we are susceptible to inflation as we don’t like it when the cost of a loaf of bread goes from $3 to $4.

But as real estate investors, we love inflation for 3 reasons. Inflation means home prices go up (appreciation), rents go up (more cash flow) and our debt is debased on our fixed interest rate loans. (Our $800 per month payment stays fixed while the purchasing power of $800 decreases meaning that, in essence, our payment goes down)

4) Respected and credible industry leaders are predicting continued price appreciation

John Burns, author of the book Big Shifts Ahead: Demographic Clarity For Business and founder of John Burns Consulting, a company that does frequent surveys of large housing industry companies is, despite interest rates bouncing back up, predicting new home prices will rise another 13% in 2021.

If you purchase a $200,000 rental home with a 25% down payment ($50,000) and it increases in value by 13%, your ROI from appreciation is $26,000/$50,000 or 52%. Even if Burns is off in a big way and prices only appreciate 7% the numbers are still extremely favorable.

Personally, I am again in contract on 2 additional fourplexes which are set to close later this month. While I’m paying significantly more for basically the same buildings in the same city than I did last March, for the reasons stated above, I feel it is in my best interest to do the deal.

Everyone’s time horizon, resources and risk tolerance vary. It’s ultra important to buy right and nothing is guaranteed. But the more experience I get in real estate the more the following quote resonates: “Don’t wait to buy real estate, buy real estate and wait”