There is a segment of the population that has been predicting a real estate crash for many years. Some have been waiting for this so that they can start investing. There is some logic to this sentiment as affordability has been squeezed and home prices have steadily appreciated over the last decade. 2008 is fresh in people’s minds. But just because values go up doesn’t mean its inevitable that they will crash.

We certainly are not seeing a housing market crash at the national level, BUT we are seeing a COVID driven crash in a segment of the residential real estate market.

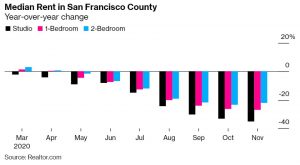

Here: Massive rent declines

As per this Bloomberg article citing Realtor.com data, the median rent for a studio apartment in San Francisco is down 35% in November compared to November of 2019. The number is 27% for 1 bedroom apartments. While rents have certainly steadily increased over the past decade, the key word is “steadily”. With 35% and 27% declines in such a short period of time it is safe to say that this segment of the real estate market has crashed.

San Francisco is not alone. Based on this Globe St. article, October rents in New York City were down 17%. The article points out that when comparing March to October of 2019 to the same period in 2018, rents in only 5 out of the biggest 100 cities saw year over year declines and in only 2 of those cities were the declines greater than 1%. Historically rents simply do not change this drastically this quickly.

Vacancy and maintenance are the bane of rental property owners. Unfortunately a segment of the investing population in places like SF and NY is getting hit hard by the rent declines as they are faced with the tough choice to either drop rents or experience painful vacancy rates.

Not there: Validation that the real estate market is hyper-local and segmented

While small apartments in NYC and SF are in the midst of a crash, other real estate segments and geographies are thriving.

This Apartment List chart shows the cities where rents are growing the most.

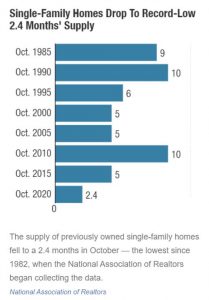

Nationally, single family homes (which are now doubling as schools, offices and gyms) are in very high demand at a time when supply is historically low. See chart below from the National Association of Realtors on just how low inventory is.

As per this NPR article, the pandemic driven demand and supply crunch have driven prices up 16% nationally year over year.

In California specifically, as per this Cal Matters article, single family home prices were up by almost 20% year over year in October as people flee the urban cores.

Is there opportunity in the big cities?

Do those who were waiting for the market to soften now have their moment? Real estate investors win at acquisition and this market turmoil, while not anticipated in the way that it manifested (global pandemic), may provide a huge opportunity. Will there be deals to be found like there was at the turn of the last decade?

Or has Covid 19 changed the way that people view urban living forever?

Work from home trends and recent migration patterns suggest that many of those leaving the hardest hit cities may never return.

But, while places like Idaho and states across the Southeast continue to attract populations from within our country, let’s not underestimate the U.S. and it’s global appeal.

America is in demand. When the pandemic is under control and assuming a cooperative immigration policy, the same thing that has happened over the last century could continue to happen at an accelerated pace. That is, more foreigners will emigrate to the big U.S. cities and backfill the lost population, spawn new economic growth and drive rents and property values back up.

Summary

Some big cities such as SF and NYC have seen major negative disruptions to their rental markets. The associated out-migration has benefitted both the suburbs and other smaller cities.

With disruption comes opportunity. Will investors look at the Covid situation as temporary and pounce?

Over time, with the pandemic getting farther and farther in the rear view mirror, it feels to me that the small apartment segment of our iconic cities which have been hit hard will bounce back, albeit with different dynamics. I will certainly be monitoring the degree to which we see people, who will need knowledge, foresight, courage, patience and resources, invest in this segment.