In our last article, How Houses Can Buy You Houses – The Power Of Equity And HELOCS, we referenced a prevailing narrative that asserts doing well in school, so you can get into a good college, so you can get a job, so you can buy a home. A home that you work at your job for 30-40 years to pay off. An additional component of this philosophy is that while you are at your job, you should invest in a 401K plan so you can have a comfortable retirement… when you turn 65

What Is A 401K Plan?

Investopedia defines 401K Plans as: “a tax advantaged defined-contribution retirement account offered by many employers to their employees. It is named after a section of the U.S. Internal Revenue Code. Workers can make contributions to their 401(k) accounts through automatic payroll withholding.”

What Are The Benefits Of A 401K Plan?

Employers typically present the option to sign up for the 401K program they sponsor along with the other important benefits they offer, like health insurance, dental insurance and flexible spending accounts etc..Here is a summary of the benefits:

Tax advantaged – The amount that you contribute into your 401K are pre-tax dollars. For example, if your salary is $100,000 per year and you decide to invest $10,000 into your 401K plan, your tax liability from your job for that year is only based on $90,000 of income. For basic math and with the caveat that you should always check with your tax professional regarding your personal situation, if you are in the 35% tax bracket, instead of paying $35,000 in taxes, you pay $31,500, saving $3,500

Potential matching – Many companies encourage employees to invest in their 401K by providing a company match typically between 2-6% of the amount invested by the employee. A nice benefit.

Appreciation – standard 401K plans typically give employees a choice of mutual funds (made up of stocks) to invest into. Historically the stock market appreciates in value over the long run. The stock market over the last 10 years has certainly been fantastic for appreciation.

Are There Drawbacks To A 401K Plan?

Can’t touch this – one of the drawbacks to 401K investing is that you are not able to withdraw the money until you are aged 59 ½ unless you are willing to pay a penalty. What happens if you find a great investment opportunity when you are 40 ½ that you are confident will help you build more wealth? What happens if you have a medical emergency when you are 51 ¾? If you want to tap into that money to offset medical bills, you can but you will get taxed at ordinary income levels. You also have to pay 10% off the top to the government as a penalty for early withdrawal. That’s right, you can get to your money, but Uncle Sam will take a nice chunk 1st.

Control, understanding & learning – not only do the plans withdrawal rules strip away some personal control, but the vehicles typically available for your 401K to invest in are limited. Most company sponsored 401K plans offer investors a group of mutual funds with varying risk profiles. You have no control over what is offered to you to invest in and you ultimately have to trust that the menu of mutual fund choices you have is solid. But would you really know? You could certainly invest your time to a) understand all of stocks that a fund invests in and b) the financial health and future prospects of each of the stocks in the fund. If you did this you would certainly learn and add value to your self (knowledge is power and investing in yourself is the best investment of all) but that sounds like a full time job in itself. It is safe to say that the vast majority of 401K investors are on autopilot. That is, they have money taken out of their periodic paychecks sent to brokerage houses without much thought. The average 401K investor does not have a deep understanding of all the factors that affect the performance of their money. They have little control over it and they are not adding value to themselves by learning along the way

Fees & management alignment – 401K plans are not free to investors. Over time fees will add up. The impact of fees is twofold: An investor pays an ever-increasing amount in fees as account balances grow, because fees are almost always based on a percentage of assets. And fees also strike a blow to the portfolio’s returns. That’s because every dollar taken out to cover management costs is one less dollar left to invest in the portfolio to compound and grow. Here is a list of potential fees paid by 401K investors:

- Brokerage fee

- Trade commission

- Mutual fund transaction fee

- Sales load

- Management or advisory fee

- 401(k) fee

It is highly unlikely that 401K investors personally know any of the people who are involved in the decisions that control their wealth. They don’t personally know the executives who run the companies whose stock they are invested in, they don’t know the leaders of the brokerage houses where they send their money and they don’t know the fund managers making fee triggering decisions like buying or selling securities. Without access to those who are in control of their money, 401K investors are left to assume that these people have their best interest at heart when making decisions.

Volatility – Investing in mutual funds and the stock market comes with volatility which hurts returns over time. Be wary of the term “average return” because it will NOT represent your “actual return” even when you don’t factor in the fees you are paying. When there is a percentage loss in the market, the gain must be much higher to balance out the loss. If you lose 10% on a $100,000 investment, you have $90,000. In order to get back to $100,000 in year 2 you would need to gain 11.1%. While the average return over that 2 year period is 0%, you would actually lose money. $100K would go to $90K in year 1 and $90K would go to $99K in year 2. You lose $1K even when the average return is 0%. Managing anything is much easier when there is a level of predictability. The volatility of the stock and mutual fund market makes managing your wealth less predictable and therefore more difficult.

Comparing 401K Investing To Buying Houses

In our November 25th 2019 article we demonstrated the powerful advantages of investing in rental property with smart debt for the long term:

- Cash flow

- Appreciation

- Tax sheltered cash flow

- Mortgage pay down

- Inflation hedge

We also referenced the drawbacks:

- Vacancy

- Maintenance

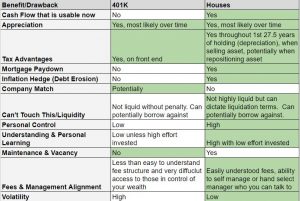

The table below summarizes and compares the benefits and drawbacks of both 401K investing and investing in rental homes

Conclusion:

There is certainly a segment of the population for which 401K investing is a great fit and there are those who have benefited from this strategy. While not a mainstream narrative, there is a very compelling case to be made that investing in rental homes, when done correctly for the long term, offers opportunity for more powerful and flexible wealth building where you have more control over your own destiny and have the opportunity to accelerate financial freedom. Investing in a 401K plan is investing for the future. Investing in rental homes is investing for both the future and for right now.