Savvy investors know that the degree of success on a real estate deal is, in large part, determined by the terms at acquisition. You win on the buy.

Is the residential real estate environment conducive to winning now? What will it look like over the next 6 to 18 months?

A Wave Of Foreclosures?

Given the major economic disruption caused by the Coronavirus pandemic, it is logical that a significant number of single family homes could be at risk of foreclosure. There was a tremendous buying opportunity in 2008-2012 when foreclosures spiked significantly. Will history repeat itself?

According to this September 9th Housing Wire Article, The share of mortgages with payments 90 days to 119 days late quadrupled between May and June, reaching the highest level in more than 21 years.

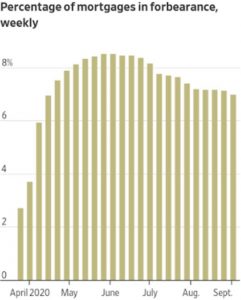

The Core Logic chart below shows how the pandemic has created a spike in the number of homes in forbearance.

While the government has put a foreclosure moratorium in place lasting through the end of 2020, with the delinquency, forbearance and true unemployment rates where they are it’s hard to imagine a scenario where we won’t see a strong uptick in foreclosures and an associated acquisition opportunity.

But This Is Not 2008

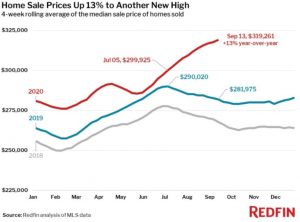

Despite all the turmoil, home prices are increasing. As per Redfin’s chart below, based on a survey of 434 U.S. metro markets, home prices are up 13% year over year in September as of September 13th, 2020.

Why & Will This Trend Continue?

Demand – One of the main drivers of home price increases is DEMAND. If you think about it, with the pandemic, the utility that one gets from a home has suddenly increased dramatically. Homes are now not only places to sleep, eat and be with family, but they are now also offices, schools and even recreation areas. With the pandemic, people are less likely to want to live in large multi family complexes with shared common areas and no personal yards. For the week ending September 13th, 2020, the seasonally adjusted Redfin Home-buyer Demand Index was up 22.5% from pre-pandemic levels in January and February.

Supply – While demand is growing, supply remains constrained. Check out the graphic below from John Burns Real Estate Consulting and note how all the major markets in the Southeast are considered as under supplied.

Interest Rates – Interest rates are at all time lows and according to the Federal Reserve, we can expect them to remain that way for at least a few years. Lower interest rates help make homes more affordable for buyers and ultimately help drive demand. With rates expected to remain low for years and lingering health concerns, it is logical that demand for single family homes will remain strong for years.

In this context of increasing utility, rising demand, low interest rates, other government stimuli and constrained supply is it surprising that we are seeing home values increase?

So What Happens When Existing Homeowners Can’t Pay Their Mortgages?

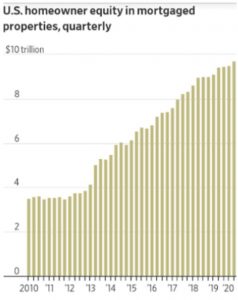

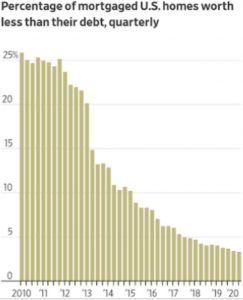

Equity – Another major difference between now and the last recession is the amount of equity homeowners have. With stricter lending standards and home price appreciation over the last decade, the amount of overall equity that owners have is more than double what it was at the end of last decade. In 2010 more than 25% of homes were worth less than the amount owed on them. That number is less than 5% today. See Core Logic charts below.

Because of this equity, homeowners have more leverage and more options. One of their options to avoid foreclosure if they can’t make their mortgage payment is to simply sell their home on the open market to get out of their mortgage obligation. See above on the state of housing demand.

Additionally, lenders and government agencies have motivation to prevent foreclosures and with equity in homes, loan modification programs to avoid foreclosure are much more palatable for all parties.

Institutional Investors – In the 2008 foreclosure crisis, supply was relatively high and as more foreclosures started to hit the market, it created a vicious cycle of price depreciation. As prices dropped, more owners fell into the “value is less than amount owed” bucket which led to more foreclosures.

In the beginning of the last foreclosure wave, institutional investors were not set up like they are today. If we do start to see foreclosures come on the market these institutions are ready, willing and able to quickly absorb inventory which will help prevent significant price declines and the type of vicious cycle from the last cycle.

As indicated in our June Article, American Homes For Rent which owns over 50,000 homes raised a large amount of money in partnership with JP Morgan to expand their portfolio. They raised another $400 million last month and according their head of finance, Christopher Lau, “We’re endeavoring to deploy that capital as quickly as possible,”

Summary

There is compelling logic that would dictate we will have a wave of foreclosures. That being said, there is also compelling logic that would dictate that housing prices will remain strong and a foreclosure wave will be avoided. Which will play out?

It will most likely be market specific. Markets where pandemic related unemployment remains high for a prolonged period of time, where population growth is stagnant and where institutional investors are not active are most at risk. Suburban markets where supply is constrained, population growth is strong and where institutional investors are active are most likely to see housing prices remain strong.