The Cambridge dictionary shows the following definition for the colloquialism have your cake and eat it too:

“to have or do two good things at the same time that are impossible to have or do at the same time”

Well, another reason that acquiring and holding leveraged real estate is one of, if not THE, most powerful tools for wealth building is that there are 3 scenarios where you CAN have two great, seemingly conflicting things, at the same time.

1) Appreciation/Depreciation

In our article titled “The Power of The Buy & Hold Model: A Team of 5 All-Stars” we demonstrated that, historically, homes go up or appreciate in value. The Case-Shiller national home price index increased by over 200% between 1987 to 2019, an average of 6.25% per year. Most bank accounts are paying less than 1% per year right now. What’s more, if you purchase a $200k home and put 20% down ($40k) and it appreciates 5% to $210k in year 1, you earned $10k on your $40k investment or 25%. Appreciation is great. Appreciation when you use leverage is tremendous.

But it gets better.

Even though homes appreciate, the government allows investment property owners to assume the opposite. The US tax law asserts that homes depreciate in value over a 27.5 year period. For the acquire and hold, cash flow investor this is huge. Why? Depreciation is a “loss with no pain” that offsets cash flow. This means that while in reality the money is flowing to your bank account, as far as the IRS is concerned it is not and therefore they won’t try and take their share.

For example, if a property owner has $10,000 of monthly cash flow and can depreciate their properties $5,000 per month ($60,000 per year) they pay taxes on only $5,000 of income even though $10,000 actually came in. Assuming a 35% tax rate, without depreciation, the investor would owe $3,500 per month or $42,000 per year in taxes on their rental property income. With depreciation of $5,000 per month they pay only $1,750 per month in taxes or $21,000 per year. A savings of over $20,000.

When investment properties are sold, depreciation is “recaptured” which can negatively affect capital gains taxes, but there are ways to avoid or mitigate this via vehicles such as a 1031 Exchange or liquidating the property with seller financing. (Note: I am not a CPA and every investor should check with their CPA on how depreciation affects their individual situation)

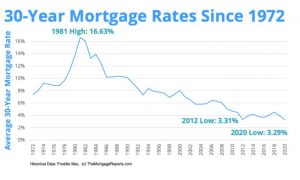

2) The 30 Year Fixed Mortgage: Benefit from interest rates going up or down

Let’s not let the power of the 30 year fixed rate mortgage go unnoticed. The United States is one of the only countries in the world that offers this long term product. For example, Australia and Canada’s system is dominated by floating or much shorter term fixed rate home loan products. Talk to some foreign investors and they will be quick to point out how good we have it here in the U.S. with the 30 year fixed.

Why? Because you win no matter which way interest rates go.

If interest rates go up, your decision to lock in before they went up is validated. They can’t take away your rate as long as you make your payments. What’s more, interest rates tend to go up when inflation starts to rise. We know as real estate investors that inflation is a friend. When inflation kicks in, home values (equity) and rents (cash flow) tend to also rise. Furthermore, your debt is eroded in an inflationary environment. If you lock in an $800 payment for a property today, your payment will be $800 in 10 years and it will be $800 in 20 years, but with inflation the value of the $800 will be less. In essence your payment goes down, because you locked it in for a long period of time. The longer you lock it in, the more likely it is to go down. How cool is that.

If interest rates go down, you can simply refinance your loan and get an even lower rate which will increase your cash flow in the present day. When you refinance to another 30 year fixed you recast the time period and give yourself even more time to have inflation debase your debt.

With a 30 year fixed rate mortgage, the lender is making a commitment to you for 3 decades. A commitment on which you do not need to reciprocate. If it makes sense to hold the loan for 30 years, you can, if it doesn’t make sense you can move on to what works better for you. And remember, mortgage interest is a tax deduction.

For context, here is the chart showing interest rates on the 30 year fixed since 1972

I locked in several 30 year fixed rate loans over the years at very low rates and frankly told myself I would NEVER want to refinance them, since the rates were so low. Never say never.

Given what’s happening in the world, rates are incredibly low now and I am in the process of restructuring mortgages on the portfolio. Remember, there are 2 sides to the wealth building equation, income and expenses. I encourage everyone to look at refinancing now as there is a great chance that you will be able to decrease your expenses.

There is some talk that 30 year fixed rate mortgages may go away in the US. Let’s hope this doesn’t happen. Let’s keep having our cake and eating it too.

3) The HELOC Strategy: Invest your money and have it too

In How Houses Can Buy You Houses – The Power Of Equity & HELOCS, we talked about home equity lines of credit as a way to acquire properties. Over time, through appreciation and your tenant paying down your mortgage, you build equity in your rental property. Did you know that this home can transform itself into a bank?

Say you have a property that is valued at $320K and you owe $100K on it. You can most likely open a home equity line of credit for $150K. 4 great features of HELOCS:

- Often can be opened up with little to no transaction costs. (No money out of pocket)

- Do not have to draw against them until you are ready to use them and have a revolving feature (Extremely flexible)

- Often come with an interest only option (Lower required monthly payments)

- Often very favorable interest rates (The cheapest money out there)

You can use the $150K to acquire another property. Since the rate is low and you can choose the interest only option, your HELOC payment will be very low. Assuming you bought right, your low payment facilitates strong cash flow.

The beauty of the HELOC strategy comes from what you can do with your cash flow and any other disposable income you may have.

With a fixed rate mortgage and it’s set amortization schedule, if you decide to make an extra or lump sum payment, your required monthly payment will not change. Making extra payments “traps” more equity in the home. With an interest only HELOC your payment absolutely changes when you make extra or lump sum payments. It goes down.

Let’s look further at lump sum payments. Financially savvy folks always have reserves on hand for unexpected expenses. Let’s assume you want to have $20k of liquidity on hand for a rainy day. You put that $20K in a saving or checking account that will most likely earn you 0-1%. Let’s assume your interest only HELOC has a 4% interest rate. If you take your 20K earning 0% and use it to pay down the balance of your HELOC to $130K you are in essence earning an extra 4%.

Initial instincts would tell us NOT to “spend” or “invest” our rainy day funds, but remember this is a revolving line of credit and therein lies the beauty of the product. Even though you put your $20k to work for you, you can get it right back if you need it by simply writing a check against your line of credit.

If you use this extra cash flow you earned by paying down your HELOC to further pay down the HELOC, it creates a virtuous cycle of ever increasing cash flow. Who doesn’t love virtuous cycles.

This FLEXIBILITY is powerful. It prevents money from sitting idly and as all wealth builders know, it’s less about working harder, and more about making your money work harder for you. Not only do lines of credit help you save for a rainy day in a much more efficient manner, but for the disciplined investor, they also allow you to have “dry powder” available to quickly take advantage of new investment opportunities when they arise.

Another thing I love about the HELOC strategy is that money that you earn has a very clear, direct and measurable PURPOSE, that is, to safely and predictably create more cash flow and amplify a virtuous cycle.

It takes discipline to execute this and it does not come without risk as most HELOCS are variable rate (the rate can go up), but when your homes turn into banks over time and when done correctly, the HELOC strategy is a powerful vehicle for wealth building

Summary

Acquire and hold real estate investors can simultaneously benefit from both appreciation and depreciation. With a 30 year fixed rate mortgage, you can get lenders to commit to you for 3 decades while not having to make the same commitment back to them unless it works for you. With a home equity line of credit you can, in essence, have your money and invest it too. Acquire and hold investors, when operating with discipline, have it pretty good.